What is Wealthify?

If you're thinking about opening an Investment ISA, General Investment account or Stocks and Shares Junior ISA, Wealthify could be just what you need to get started. It's a way to invest your money simply, without all the confusing jargon and puzzling charts.

All you’ll need to do is tell Wealthify what your investment goals are, and a bit about how you want to reach them and the risk level that you’re comfortable with.

Remember, investments can fall as well as rise, and you could get back less than you put in.

The tax treatment of your investment will depend on your individual circumstances and may change in the future.

How much it costs

Wealthify believes in keeping fees low and transparent so you can get the most from your money. Unlike some providers, you won’t be charged to deposit or withdraw money, transfer or close your plan.

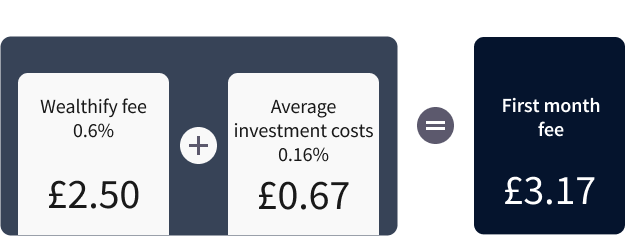

You’ll pay one monthly fee that’s made up of two parts:

Your fee is based on the value of your investments so the exact amount will change from month to month. Here's an example of what your first month's fee could be if you invested £5,000.

The illustration above is based on an investment of £5000 with a monthly Wealthify charge of 0.6% equal to £2.50 and monthly average investment costs of 0.16% at £0.67. This gives a first month fee of £3.17. Wealthify charge one fee for management costs which is calculated on an annual basis but is shown as a monthly fee for clarity.

Before you apply

A few things you need to know before you can open an account.

The tax treatment of your investment will depend on your individual circumstances and may change in the future.

To open a Wealthify account you need to be:

- Over 18

- A UK tax resident

- Whether you’re within the maximum allowance each year - currently £20,000 across all ISAs you have, or £9,000 for junior ISA

- Shouldn’t have opened or be contributing to a stocks and shares ISA, other than a lifetime ISA, this tax year (from 6 April to 5 April)

And if you're transferring an ISA, bear in mind:

- It doesn’t count towards your ISA allowance, unless you paid into an ISA this tax year

- You can transfer an ISA you’ve paid into this tax year, but you have to transfer the whole amount and it will count towards this year’s ISA allowance

- You might be charged by your current provider, so check before you do anything

- It can take between 3 to 6 weeks to cash in, transfer and reinvest your money – your investment won’t be affected by any changes in the markets during this time

Set sail on your investing journey

Pick your preferred Wealthify investment account and try out their ‘Build a Plan’ feature to see how your money could perform over time.

Exploring your options

There's more than one way to make your money work harder. Here’s a few other ways you can do it.

Remember investments rise and fall in value. There’s a chance you’ll get back less than you put in.

Wealthify Stocks and Shares ISA

Invest tax-efficiently with a Wealthify Stocks & Shares ISA and make full use of your £20,000 allowance each year.

Wealthify Investment Account

When you want to invest beyond your ISA limit, you could choose professionally managed funds, starting with a lump sum or by making monthly payments. Inflation will reduce the spending power of your money.

Wealthify Junior ISA

Invest for your child with a Wealthify Junior ISA and help kick-start their financial future.

Top up your knowledge

Whether you're a beginner or keen investor these articles can help with managing your money.

Contact us

Need help with Wealthify?

0800 802 1800

Monday to Friday: 8:00am – 6:30pm

Saturday: 9:00am – 12:30pm

To protect both of us, we may record and monitor telephone calls. These recordings will be saved for at least 5 years. Calls to 0800 numbers from UK landlines and mobiles are free. Our opening hours may be different depending on which team you need to speak to.

Your privacy

If you click through to Wealthify, we’ll share some of your personal information with them so that you can receive the offer and to help fill out any forms in case you want to apply. To see how we take care of your data, visit here. For information on how Wealthify process your data, visit here.

Wealthify and Aviva

Wealthify is part of the Aviva group of companies and is authorised and regulated by the Financial Conduct Authority. Aviva UK Digital Limited acts as an introducer to Wealthify Limited for ISA and General Investment Accounts. The underlying investment management services are provided by Wealthify Limited, not Aviva UK Digital Limited.

Aviva UK Digital Limited is registered in England No. 09766150. Registered office: 8 Surrey Street, Norwich, Norfolk, NR1 3NG. Authorised and regulated by the Financial Conduct Authority. Firm Reference Number: 728985. Aviva UK Digital Limited and Wealthify Limited are subsidiaries of Aviva Group Holdings Limited.

Wealthify and you

This offer is being made to you without regard to your specific investment objectives, financial situation or particular needs and therefore this offer doesn’t imply that Wealthify is suitable for you, and isn’t a personal recommendation of any kind. If you’re unsure about investing and need advice, have a chat with our Advice Support Team who will put you in touch with a financial adviser. Call us on 0800 092 8215 or visit aviva.co.uk/advice

_900x506+(1).$16x9-mobile-4cols$.jpg?$16x9-mobile-4cols$)

_900x506.$16x9-mobile-4cols$.jpg?$16x9-mobile-4cols$)