What is critical illness cover?

It’s an insurance policy that helps protect your income if you’re diagnosed with a critical illness. For times when you can’t work, tax-free cash can offer one less worry and maybe even a better night’s sleep.

The benefits of critical illness cover

How does critical illness cover work?

When you pay monthly premiums for the policy term, we'll be standing by to pay out the cover amount if you're diagnosed with one of the 52 conditions listed on our policy plan. Our policy also includes a children's benefit that covers any children you have at no extra cost.

Do you need critical illness cover?

No one can predict your future health, but you can prepare yourself financially. It's like having a fire extinguisher in your house. You may never have to use it, but you’ll be glad it’s there if you need it.

Think about expenses you’d need to cover if you were critically ill and couldn’t work. From feeding your family to balancing your bills, making ends meet without your normal income can be the toughest nut to crack. That’s why critical illness cover comes in useful.

How much critical illness cover do I need?

It depends on things like what you want to cover, how much you’re looking to pay each month, and for how long. Our critical illness cover normally comes in at under £19 a month, according to figures from September 2022 to September 2023. But we’re all different, so you’ll be quoted a price we piece together based on things like your policy’s length, amount you’ve asked for and medical history.

Why get critical illness cover?

Did you know?

- Around 1.4 million people alive in the UK today have survived a heart attack Footnote [2]

- There are 1.3 million stroke survivors in the UK Footnote [3]

- 1 in 2 will develop some form of cancer in their lifetime Footnote [4]

Our phones ring the most for claims relating to cancer, heart attacks, strokes, multiple sclerosis and Parkinson's disease. But we're happy to cover as many as 52 illnesses, which are listed in the critical illness policy summary (PDF 113KB).

How critical illness cover helped Linda when she needed it most

Linda took out critical illness cover with us when she bought her house. Within a few years, she got some bad news completely out of the blue. Here’s how we could help her at this difficult time.

How to choose the type of critical illness cover that’s right for you

It's all down to what you want to protect and how much you're willing to set aside each month. Pick between level cover (a set amount which you can also protect from inflation) or decreasing cover (the amount you’ll get drops over time).

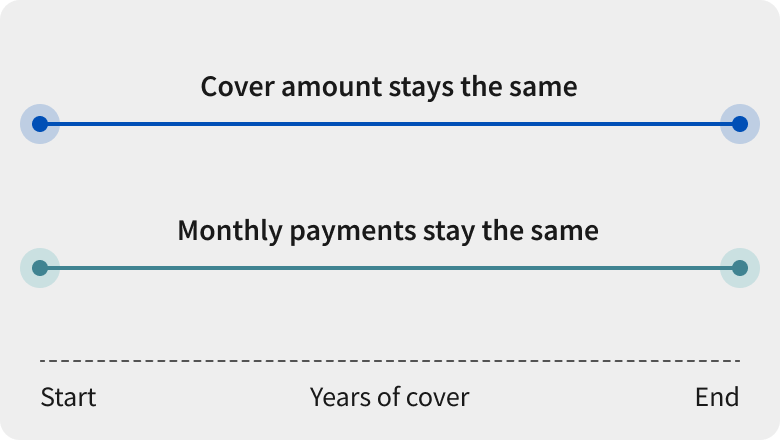

Level cover

With level cover, you choose the cover amount and how long you want the cover to run for. The amount of cover and the amount you pay each month stays the same until your policy ends.

Level cover could be a good option if you're looking to help maintain a loved ones' living standards, and the lump sum can help to cover things like:

- Your salary

- Any additional health and living costs

- Rent payments

- Continue to make mortgage payments

- Children’s school fees or other childcare costs

Protecting your cover from inflation

You can choose to make your cover amount increase in line with inflation. This means that your monthly payments may rise, and ensures the lump sum won’t be worth less in the future because of the rise in the cost of living.

If you choose this option, the maximum annual increase would be 15% to your premium and 10% to your cover amount. Footnote [5]

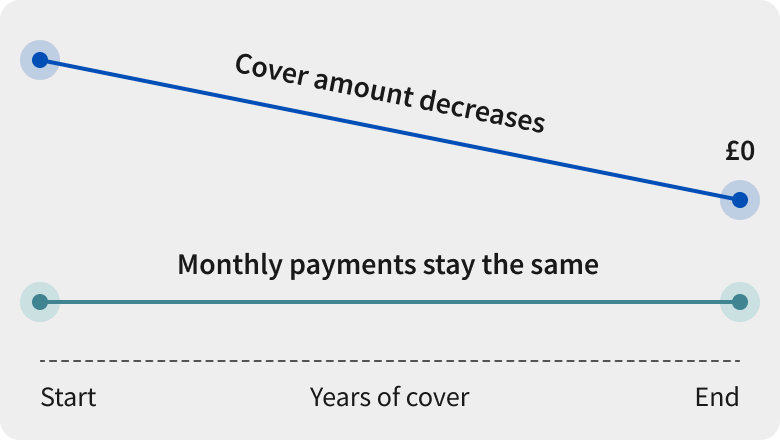

Decreasing cover

This could be a great option to help pay off a mortgage, debt or other loans if you're diagnosed with one of the defined illnesses while the policy’s active.

- Just like level cover, it has an expiry date, and your monthly payments are set in stone unless you change your policy

- In general, decreasing cover is lighter on your wallet than level cover as it's only there to pay off loans and debts you’re chipping away at. The payout amount won't need to be as high if you claim as you'll owe less money over time.

Are you eligible for critical illness cover?

To get cover, you'll need to:

What our critical illness insurance covers

If you already have critical illness cover with us, check what conditions you’re covered for in your policy documents, as it may be different from what’s detailed below.

These are included:

These aren't included:

5 minutes and done

Getting a quote could be done by the time you’ve boiled the kettle. Combining life insurance and critical illness cover can be done on our life insurance page.

All we need to know is:

- Your date of birth

- Whether you smoke

- How much cover you need

- How long you want to be covered for

Or call us free

0800 068 5549

Monday to Friday 8:00am - 6:00pm

Weekends and bank holidays: Closed

Calls may be monitored or recorded. Calls to 0800 numbers from UK landlines and mobiles are free.Our opening hours may be different depending on which team you need to speak to.

Critical illness cover FAQs

Am I eligible for a critical illness policy?

Which critical illnesses are covered under this policy?

Will my children be included in my critical illness policy?

How much does critical illness cover cost?

How do I make a critical illness claim?

Why choose our critical illness cover?

Looking for more cover?

Here are some other ways to help protect your family’s future.

Life insurance

Income protection insurance

Free Parent Life Cover

Life and critical illness insurance articles and resources

Get insight and useful info on protecting you and your family.