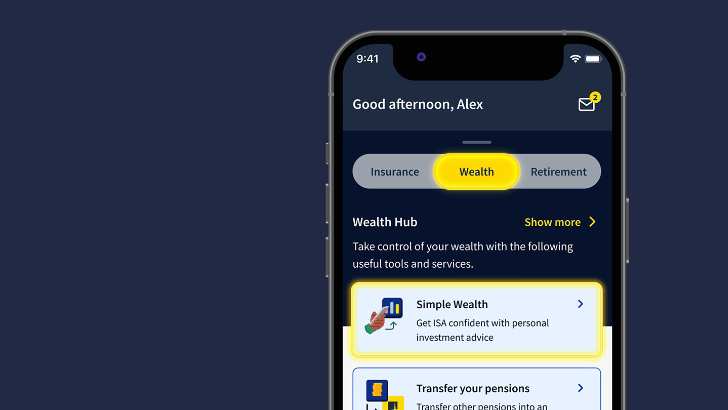

How Aviva Simple Wealth works

Download the MyAviva app and answer a few questions

By getting to know you, we can find out if investing is right for you, what your plans are and which investment style suits you best.

Pay your one-off fee, get your advice and schedule an Aviva Money Coach call

For just £60, we'll use your answers to recommend an ISA investment from a selected range of ready-made funds. You can choose to talk it through with an Aviva Money Coach.

Open your Stocks & Shares ISA with a few clicks

If you're happy with your digital advice you can open your ISA in moments and start investing from just £25 a month, or a lump sum of £500.

Is Aviva Simple Wealth right for me?

Aviva Simple Wealth can help you get started with investing, which can be the key to better long term returns. It could be right for you if:

Remember that tax benefits are dependent on your circumstances and can change in the future.

For more information about Aviva Simple Wealth and to find out how we use personal information and your rights, read our Aviva Simple Wealth service document which includes our privacy notice.

Our Aviva Money Coaches

Aviva Money Coaches are experienced professionals who are there to offer friendly support, if you need it, to help you start your investing journey. Using Aviva Simple Wealth, you can schedule a 30-minute phone call with our Money Coaches at a time that suits you.

Aviva Simple Wealth FAQs

What will my advice tell me?

Aviva Simple Wealth matches you with an Aviva Stocks & Shares ISA investment selection that fits your financials goals and feelings about risk and reward. Your personalised digital advice helps you understand how your money could grow and includes useful information about tax, risk and cost, to put investing within your comfort zone. If you're happy with your advice, you can open your ISA with a few clicks in the app.

Could I invest myself without advice?

Anyone can invest on their own but if you're new to investing, the range of choices and financial terms could feel confusing. Aviva Simple Wealth is designed to find an investment selection that works for you from a selected range of ready-made funds. It uses simple questions backed by behavioural science to deliver personalised advice. You'll also get the benefit of guidance from our Aviva Money Coaches in an optional one-to-one chat.

What information do I need to start my Aviva Simple Wealth journey?

Starting your Aviva Simple Wealth journey is easy and free to try. You don't need any paperwork to get started. With some simple information about your financial situation and feelings towards investing, you can find out whether investing is right for you and discover your investment style for free. To unlock your digital advice, all you need is your card details to hand to pay your £60 one-off fee.

How much time should I put aside for Aviva Simple Wealth?

It can be as quick as 20 minutes to get your digital advice, Aviva Simple Wealth works at a pace that suits you. Take as long as you need to answer your questions and once you have paid, your advice will be generated in seconds. When you have received your advice, you can choose whether you would like to schedule a 30 minute Aviva Money Coach call at a time that works for you.

What can I expect from my Aviva Money Coach call?

Your Aviva Money Coach is there to answer your questions. They're experienced professionals that can walk you through your digital advice and help you understand your recommended investment choice and how your advice has been personalised to you. Just remember, our Aviva Money Coaches can tell you what you could do but not what you should do. They cannot change your digital advice.

What questions could I ask my Aviva Money Coach?

Our Aviva Money Coaches are here to help and there are no silly questions. To give you a few ideas, here are some examples:

- I don't understand a term in my advice, can you tell me what this means?

- What might be the tax benefits of growth in an ISA compared to interest on a cash savings account?

- Can you explain how my advice matches my investment style?

What is an Aviva Stocks & Shares ISA?

Our award-winning Stocks & Shares ISA is a smart way to invest.