What is critical illness cover?

Critical illness cover is designed to pay out a lump sum if you are diagnosed with a critical illness covered by the policy during the policy term. It doesn’t pay out unless you survive for a specified period after meeting the policy definition. This tends to be between 10 and 28 days dependent on the product. Whilst some critical illness definitions will pay out on diagnosis of a condition only, others will require the condition to have progressed to a set severity or named treatments to be had to meet the definition. It's worth noting that this is not a savings or investment product and will only pay out when a successful claim is made.

How our critical illness cover works

Are you eligible for critical illness cover?

You must to be aged between 18 and 64 to apply for this policy. For a joint policy, the maximum age applies to the oldest life covered.

At the time you complete the application you must:

- be in the UK, with the legal right to live in that jurisdiction, and

- consider your main home as being in the UK, and have no current intention of moving anywhere else permanently.

The UK does not include the Channel Islands, the Isle of Man or Gibraltar.

What our critical illness insurance covers

If you already have critical illness cover with us, check what conditions you’re covered for in your policy documents, as it may be different from what’s detailed below.

These are included:

Important to know:

- If you’re diagnosed with a critical illness outside the policy term

You’re only covered during the policy term.

- If you die

Your policy will end and we won’t pay out. This is also the case if you die within 10 days of diagnosis. If you have a joint policy and one person dies, the policy will still cover the other person. - This is not a savings or investment plan

We'll only pay out on a successful claim. As this is not a savings or investment plan, there is no cash-in value at any time. If you stop paying premiums when they're due or if you cancel the policy, your cover will end. - If you’re diagnosed with a critical illness not listed in our policy

You’re only covered for the conditions listed. - This policy ends if it pays out

The policy only pays out once, unless it’s a children’s claim or an additional critical illness claim.

Why choose our critical illness cover?

How to choose the type of critical illness cover that’s right for you

It's all down to what you want to protect and how much you're willing to set aside each month. Pick between level cover (a set amount which you can also protect from inflation) or decreasing cover (the amount you’ll get drops over time).

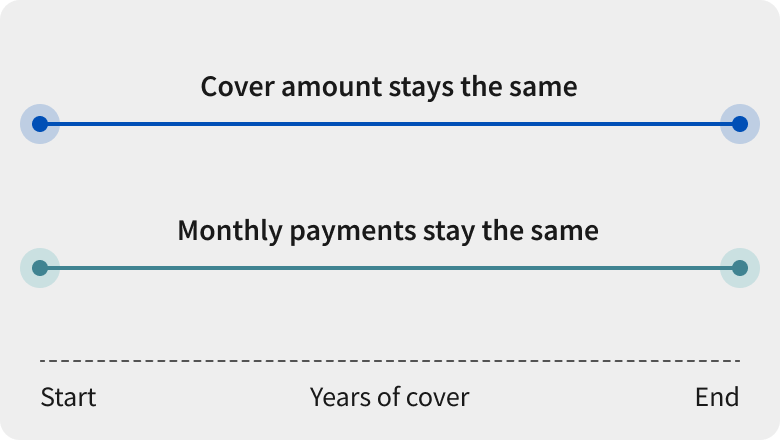

Level cover

With level cover, you choose the cover amount and how long you want the cover to run for. The amount of cover and the amount you pay each month stays the same until your policy ends.

Level cover could be a good option if you're looking to help maintain a loved ones' living standards, and the lump sum can help to cover things like:

- Your salary

- Any additional health and living costs

- Rent payments

- Continue to make mortgage payments

- Children’s school fees or other childcare costs

Protecting your cover from inflation

You can choose to make your cover amount increase in line with inflation. This means that your monthly payments may rise, and ensures the lump sum won’t be worth less in the future because of the rise in the cost of living.

If you choose this option, the maximum annual increase would be 15% to your premium and 10% to your cover amount. Footnote [3] The cover amount increases in line with the Consumer Prices Index (CPI), calculated over 12 months. To calculate the increase to your premium, we multiply what you pay by 1.5 and the percentage increase in CPI. If there’s no increase in the CPI there’s no change to your cover or premium over a 12 month period.

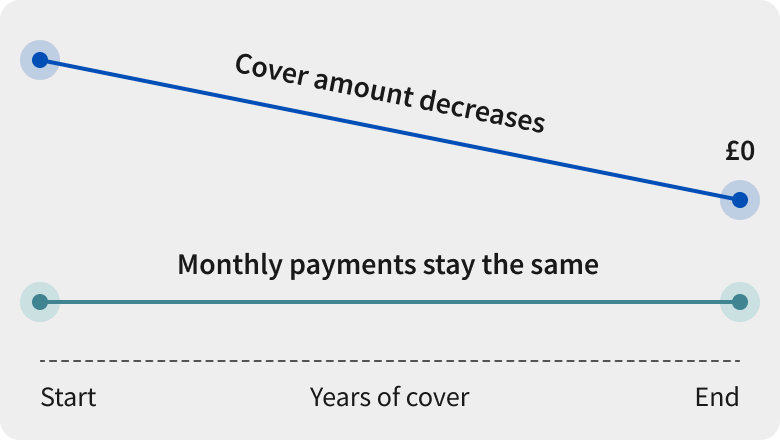

Decreasing cover

This could be a great option to help pay off a mortgage, debt or other loans if you're diagnosed with one of the defined illnesses while the policy’s active.

- Just like level cover, it has an expiry date, and your monthly payments are set in stone unless you change your policy

- In general, decreasing cover is lighter on your wallet than level cover as it's only there to pay off loans and debts you’re chipping away at. The payout amount won't need to be as high if you claim as you'll owe less money over time.

Critical illness cover FAQs

Am I eligible for a critical illness policy?

Which critical illnesses are covered under this policy?

Will my children be included in my critical illness policy?

How much does critical illness cover cost?

How do I make a critical illness claim?

How do I get a critical illness cover quote?

Getting a quote could be done by the time you’ve boiled the kettle. Combining life insurance and critical illness cover can be done on our life insurance page.

All we need to know is:

- Your date of birth

- Whether you smoke

- How much cover you need

- How long you want to be covered for

Or call us free

0800 068 5549

Monday to Friday 8:00am - 6:00pm

Weekends and bank holidays: Closed

Calls may be monitored or recorded. Calls to 0800 numbers from UK landlines and mobiles are free.Our opening hours may be different depending on which team you need to speak to.

Transcript for video Our critical illness cover

Critical Illness

A lot of us think we’ll never be diagnosed with a critical illness but in reality, it could happen to anyone.

How would you and your family cope financially if you became ill?

Whether it’s paying for treatment or helping to cover your salary while you get better, our Critical Illness Plan could make a big difference.

Our Critical illness Plan pays a lump sum if you’re diagnosed with or need surgery for a critical illness that meets our definition and if you survive for 10 days.

This type of policy isn’t a savings or investment plan – it only pays out on a successful claim and doesn’t pay out on death.

If premiums stop the cover will end.

If you’re a UK resident and aged between 18 and 64, our Critical Illness Plan could help give you peace of mind for the future.

Our plan lets you choose a policy length that works for you, from 5 to 50 years, or up until your 75th birthday.

Plus, you can get cover for the kids too; keeping the whole family protected.

We cover over 50 conditions including nearly all types of cancer, as well as heart attacks and strokes.

There are two types of cover - level cover and decreasing cover.

With level cover, what you pay each month stays the same for the whole term of the policy, and so does the cover amount.

And if you’d prefer your cover amount to rise with the cost of living, you can choose to protect it against the effects of inflation, which means that what you pay will also increase over time.

Decreasing cover works like a repayment loan, with a fixed interest rate. So, the value of your cover decreases gradually, but the amount you pay stays the same.

When it comes to how much cover you’ll need, everyone’s different.

How much would you need to cover your monthly outgoings or pay for unexpected treatment costs?

Think about everyday costs like household bills and childcare that would help you and your family live life as normally as possible.

Even a small amount of critical illness cover could allow you to take the time you need to recover or have a well-deserved holiday.

We’re here when you need us most.

Looking for different cover?

We have other types of protection cover to help during difficult times. These policies offer you a specific type of protection cover and are not savings plans.

Life insurance

Life insurance

Also known as ‘term life insurance’. Pays a lump sum that could be used to help your loved ones pay bills, mortgage repayments, school fees, and any other debts, if you die within the policy term.

Age: 18-77

Cover: Up to £5,000,000

Over 50 Life insurance

Guaranteed life insurance cover for the rest of your life that pays a lump sum when you die. If you die within the first 12 months of anything but an accident, we’ll pay an amount equal to the premiums you’ve paid, but not the cover amount. We won’t ask you any health questions when you apply.

Age: 50-80

Premium: £5-£100

Income protection insurance

Pays a proportion of your lost earnings, which could help you cover your monthly outgoings if you can't work.

Age: 18-59

Cover: Monthly benefit between £500 and £1,500

Life and critical illness insurance articles and resources

Get insight and useful info on protecting you and your family.