How much is over 50s life insurance

See how much over 50s life insurance can cost

Over 50's life insurance is generally not a savings or investment product. It will only payout on a successful claim.

The cover amount is fixed so its real-life value will go down over time because of the effects of inflation.

Over 50 life insurance is cover specifically aimed at anyone, you guessed it, over 50. It’s also known as ‘Whole of life’ cover as it lasts for as long as you’re alive rather than a set period of time and then will pay out a lump sum when you pass away.

How much it costs is dependent on you. When you go through to get a quote, you’ll generally be asked how much cover you want and based off that, and a few other factors, you’ll be given your monthly or yearly premium quote.

When should I get over 50s life insurance?

As a general rule, there’s never a wrong time to take out cover. Typically, when you take out life insurance at a younger age, you’ll receive a higher level of cover for the same monthly premium compared to someone older. This means your money goes further, even if the premium itself doesn’t change. You might have a specific reason for taking out over 50s life insurance, such as helping to cover funeral costs or leaving a gift behind for loved ones.

It’s worth remembering that cover will only continue as long as you pay your premiums.

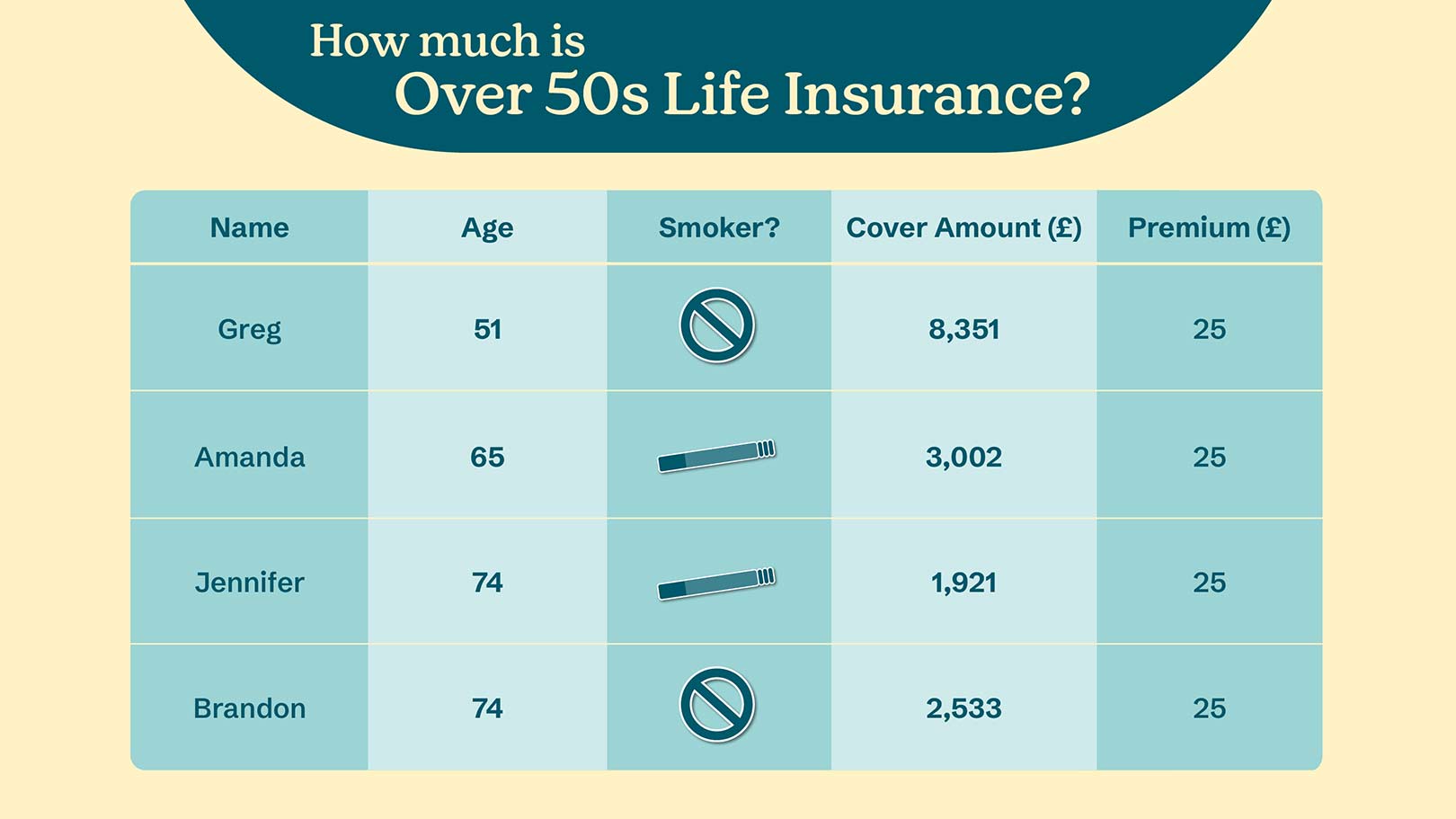

Examples of our payouts and costs

The cover amount is set when cover is taken and remains the same. In the example shown above, we cap the premium at £25. Greg, who is 51 and doesn’t smoke, would be eligible for a cover amount of £8,351. As age increases, the sum assured decreases, even for non-smokers. Brandon, aged 74 and also a non-smoker, would receive £2,533. Amanda, a 65-year-old smoker, would be eligible for £3,002, while Jennifer, also a smoker at age 74, would receive £1,921. This gives you an idea as to how we calculate risk and coverage, where factors like age and smoking can influence the level of cover for a fixed monthly premium Footnote [1].

It’s also worth noting that maximum monthly premiums are £100 and you might end up paying more in total premiums than the amount paid out in a successful claim.

Calculating how much over 50s life insurance you need

There are a few different things you might want to think about to work out how much cover you might need:

- Would you like to leave your family or friends any money?

- Is your funeral paid for with other forms of cover or savings?

- Will you be leaving any debts behind?

Working this out can give you an idea as to how much of a payout you might want to leave behind.

Next article

Term life insurance vs over 50 life insurance – which is right for me?

Explore your options so you can help protect the people you care about most