What is UFPLS and how does it work for SIPPs?

Uncrystallised Funds Pension Lump Sums are a retirement option that allow you to take a flexible lump sum from your pension.

Uncrystallised Funds Pension Lump Sums or UFPLS are a retirement option that allow you to take a flexible lump sum from your pension. Although it’s a mouthful, it’s fairly simple to explain.

Understanding UFPLS

UFPLS lets you take parts of your pension when you like. So, if you haven’t decided what you’d like to do in the long run, or need bits and bobs here and there to get you through, UFPLS might be a good option. Not all providers will allow you to take only part of your pension as an UFPLS, so please check with your current provider.

You’ll receive 25% tax-free and the rest is taxable at your normal rate. Tax benefits will depend on your circumstances and may change in the future, and this is subject to your Lump Sum and Death Benefit Allowances (LSABA).

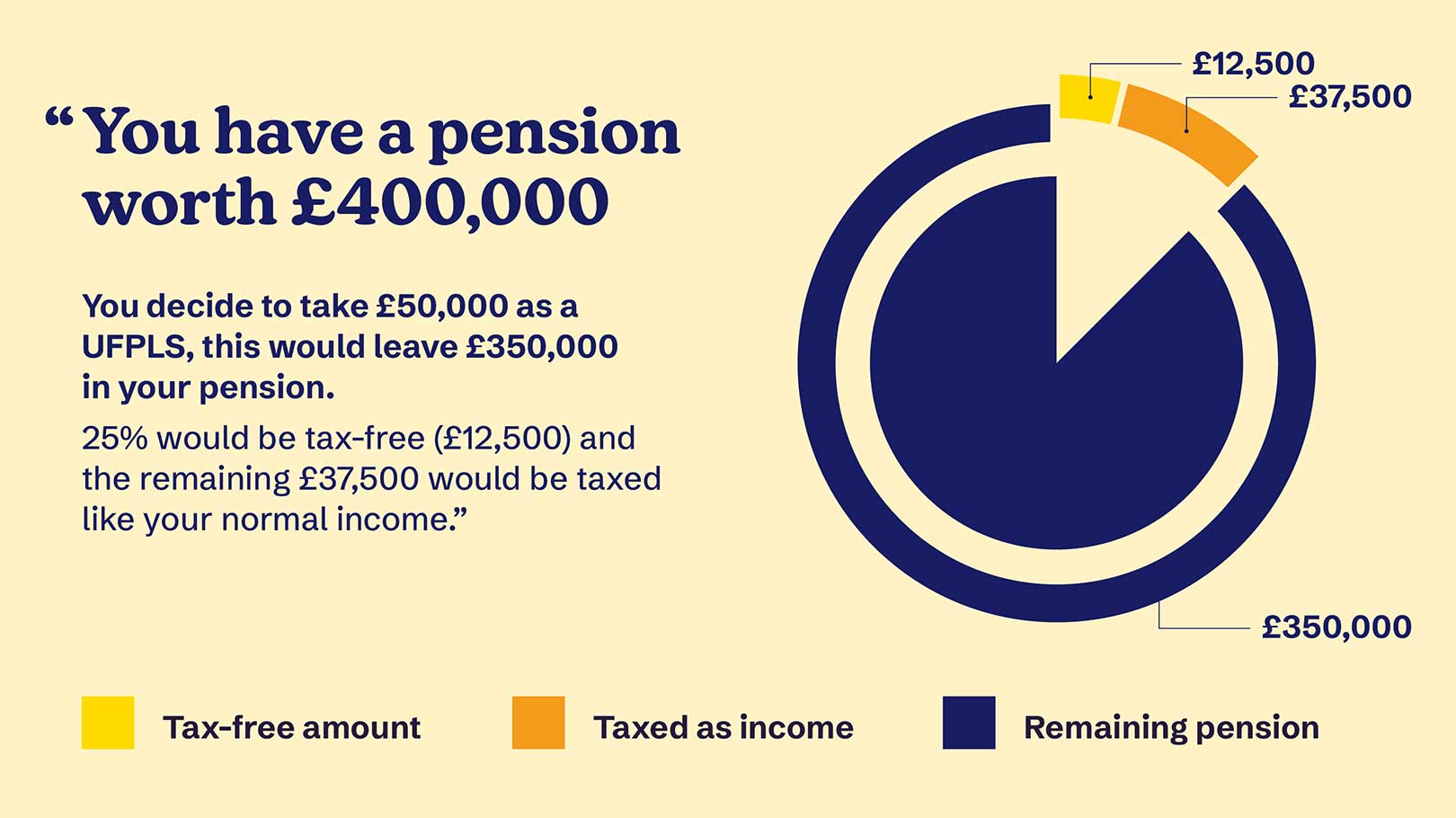

So, it could look something like this:

You have a pension worth £400,000. You decide to take £50,000 as a UFPLS, this would leave £350,000 in your pension.

25% would be tax-free (£12,500) and the remaining £37,500 would be taxed like your normal income.

But you don't have to take your whole pension this way, making it a flexible option. Depending on your provider, you could decide later that you want to go for an annuity or drawdown.

You can find out more about using your pension money by checking out our handy guide.

UFPLS vs drawdown

Drawdown or flexi-access drawdown (FAD) is another way you can take your pension flexibly as you’re able to take payments when you want too.

The main difference is how you can take your tax-free cash.

If you're doing FAD you can choose to take 25% of your whole pension pot as one tax-free lump sum or take smaller amounts of tax-free cash over time. Whichever option you choose, HMRC rules mean that for every £1 you take as tax-free cash, £3 will go into your flexi-access drawdown account.

Any money you take from your flexi-access drawdown account, or as UFPLS will be taxable, and once you start taking any money you'll trigger your money purchase annual allowance (MPAA).

UFPLS vs annuity

If you’re considering an annuity, then you’re locked into this from the point of purchase. You’ll use the value of your pension to ‘buy’ an annuity, and in return you’ll receive a guaranteed income for life. You can still decide to take your 25% tax-free cash before you buy your annuity, or you can choose to use this amount to boost your payments.

An annuity doesn't have the flexibility of taking lump sums as and when you need them, but it does give you the certainty of a regular income. And buying an annuity doesn't usually trigger your money purchase annual allowance. So, think carefully about what you’d like to do, or speak to a financial adviser.

Benefits of using UFPLS

You could benefit from using UFPLS if you’re unsure what you want to do with your pension in the long term. If this is you, then financial advice might be the way forward. Having someone help you understand each option and help you work out what might be the best option for you might just be what you need. So, if you’re trying to wrap your head around it and struggling, we might be able to help! Find out if you’re eligible for Aviva Financial Advice.

UFPLS is also quite simple compared to other retirement products, as well as flexible. Money only comes out when you ask for it, in the amount you need. Allowing you to spread your pension income across different tax years and help you reduce a tax hit.

Potential drawbacks of UFPLS

Although a good option for some, UFPLS also has drawbacks.

UFPLS is generally an interim source of income, if you don’t have a long-term strategy. It’s also good to remember that while your money is still in the pension it will be invested so it can go down as well as up and you may get less than what you put in. Your money could also run out.

There are also tax implications when taking UFPLS. Firstly, depending on the type of pension you have you may trigger your MPAA, and therefore reduces your annual contribution allowance to £10,000 if you have a defined contribution pension. You’ll also need to check whether your annual allowance has changed, this isn’t much of a problem if you aren’t planning to carry on contributing to your pension pot, but still worth noting if you’re in employment.

Secondly, at least 75% of your pot is taxed as income. So, taking UFPLS might push you into a higher income tax bracket.