How does private health insurance work

Explore the benefits, coverage, and limitations of private health insurance in our comprehensive guide.

From the bumps and scrapes you may see coming (and can prepare for), to those that aren’t always expected or visible, you may wonder about private health insurance.

Key points

- Private health insurance helps you get access to medical treatment when you need it, often giving you more choice over where and when you're treated.

- Medical underwriting is how insurers look at your health history to decide what’s covered in your policy.

- Some conditions you’ve had before might not be covered straight away, if at all, depending on the type of underwriting you choose.

- You can usually track your health and manage your policy online, making it easier to stay on top of things.

What is private health insurance?

It’s a type of coverage that can help manage the costs of healthcare services, outside those available from national healthcare.

Public health insurance, like the National Health Service (NHS), is normally paid for by the government and it’s available to all citizens (and most residents). Private health insurance, however, is available through private companies and often means you’ll pay for it through premiums (more on this below).

You may be able to get private healthcare through your workplace benefits scheme, but if that’s not an option, you could go directly to an insurer for cover. |

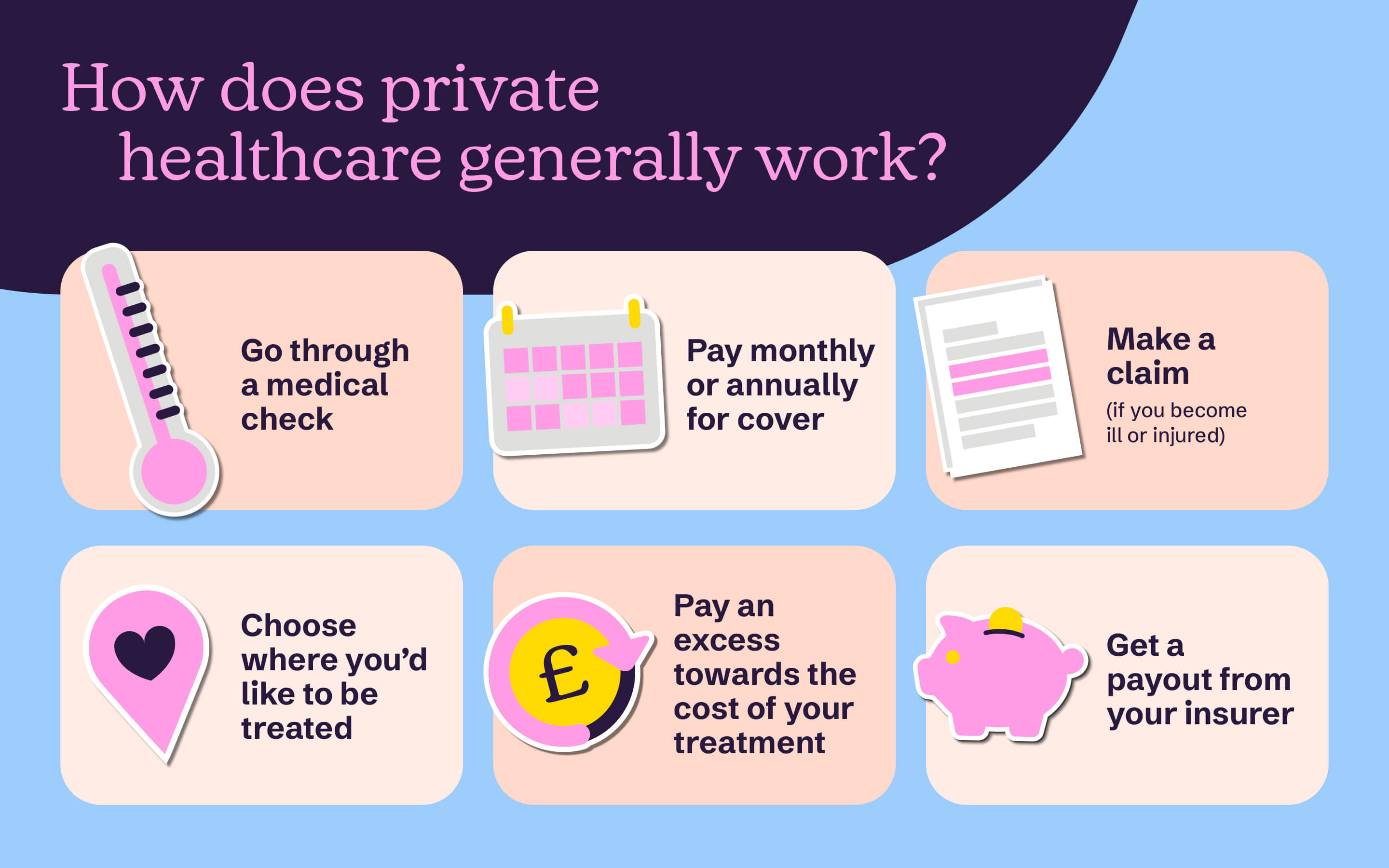

How does private health insurance work?

Although it varies between healthcare providers, it generally works like this:

Once you’ve found a provider that meets your needs, you’ll likely go through a screening process reviewed by a medical underwriter.

What does medical underwriting mean?

It’s a process taken by insurance companies to figure out your health status to decide if you’re eligible for cover and to crunch the numbers on the premium rates you may pay.

Generally, this means they’ll look at your medical history and current health conditions. Some may also invite you to complete a medical examination. The point of medical underwriting is to figure out the risk of insuring someone and price their insurance policy based on this risk.

And there are two different approaches to figuring out health risks for insurance policies: moratorium underwriting or full medical underwriting. Here are the key differences:

| In terms of | Moratorium Underwriting | Full Medical Underwriting |

| Pre-existing conditions (more about this below) | These may be covered after a waiting period, for example, two years without medication, diagnostic tests, treatment or advice. | They’re looked at when starting the policy and aren’t often included in the cover. |

| Medical history | Generally, you don’t need to give a full medical history when taking out the policy. | Generally, you’ll need to give a detailed medical history and complete a health questionnaire. |

| Claims process | Each claim you make might need a review of your medical history. | Your medical history was already looked at, so your claims process may be quicker. |

| Premiums | Generally, you may find lower premiums. | Because of the detailed assessment, premium may be higher. |

What our expert says:

Sometimes, it may feel overwhelming to understand how private health insurance works, but it’s important to explore what medical underwriting may mean for you. When you have a better idea of how it works, you can choose how you’re assessed and then find the private health insurance that meets your needs.

Darren Ives PMI Medical Underwriting

How to track your health

As you’re thinking about private health insurance, you might also think about how to figure out your own health status and goals within your health and wellness journey.

And we may be able to help with some of our calculators.

If you’re tracking your health, check out our:

- Alcohol units calculator - being aware of how much alcohol you drink can make for a healthier lifestyle. This tool can help you monitor your drinking levels by converting the booze you drink into measurable units.

- BMI calculator – your body mass index (BMI) is a way to gauge if you're a healthy weight for your height. Having a BMI above your healthy weight range could increase your risk of serious health problems, like heart disease or Type 2 diabetes. A BMI that’s below your healthy weight range can disrupt your health too.

- BMR calculator – your basal metabolic rate (BMR) is the minimum number of calories your body needs to keep up basic functions, like breathing, digestion and blood flow. Our BMR calculator can help you determine how many calories you want to burn or consume based on your BMR score, exercise routine and health goals, as well as giving you a better understanding of your body. This tool can you figure out how many calories you want to burn or consume based on your BMR score, exercise routine and health goals.

What is a pre-existing medical condition?

It’s a health problem or illness that you already had before you got new health insurance. For example, if you had asthma or diabetes before signing up for a new health plan, those would be viewed as pre-existing conditions. Insurance companies often want to know about these conditions because they might affect how much they need to pay for your medical care.

It’s worth understanding that it’s not simply about the condition itself. It’s also about the severity (how bad), the duration (how long), and the frequency (chance it’ll come back). Let’s look at back problems, for example.

| The situation | Severity | Duration | Probability |

| You hurt your back reaching for the remote hiding under the couch | Limited movement and shooting pain when standing or sitting | Lasted three weeks | Low probability with continued stretching and regular exercise |

| You hurt your back playing a contact sport a few years ago | Limited movement and shooting pain when standing or sitting | Ongoing | High probability, even with continued pain management, physiotherapy and potential surgery |

Hurting your back after reaching under the couch for the remote won’t likely be seen as a pre-existing condition. Painful and unfortunate, for sure. Although it lasted three weeks, and was quite painful, it’s likely a one-off with regular exercise and stretching.

However, hurting your back playing a contact sport with years of ongoing pain management, physiotherapy and medical interventions, may be seen as a pre-existing condition. In this case, the severity and duration mean there’s a higher probability of it either happening again or continuing to need medical attention.

Some insurers may give you a choice in how they assess any pre-existing conditions. They either use moratorium underwriting or full medical underwriting, which you can find out more about with our handy video exploring their differences.

And you can check out more details about whether pre-existing conditions are covered by health insurance.

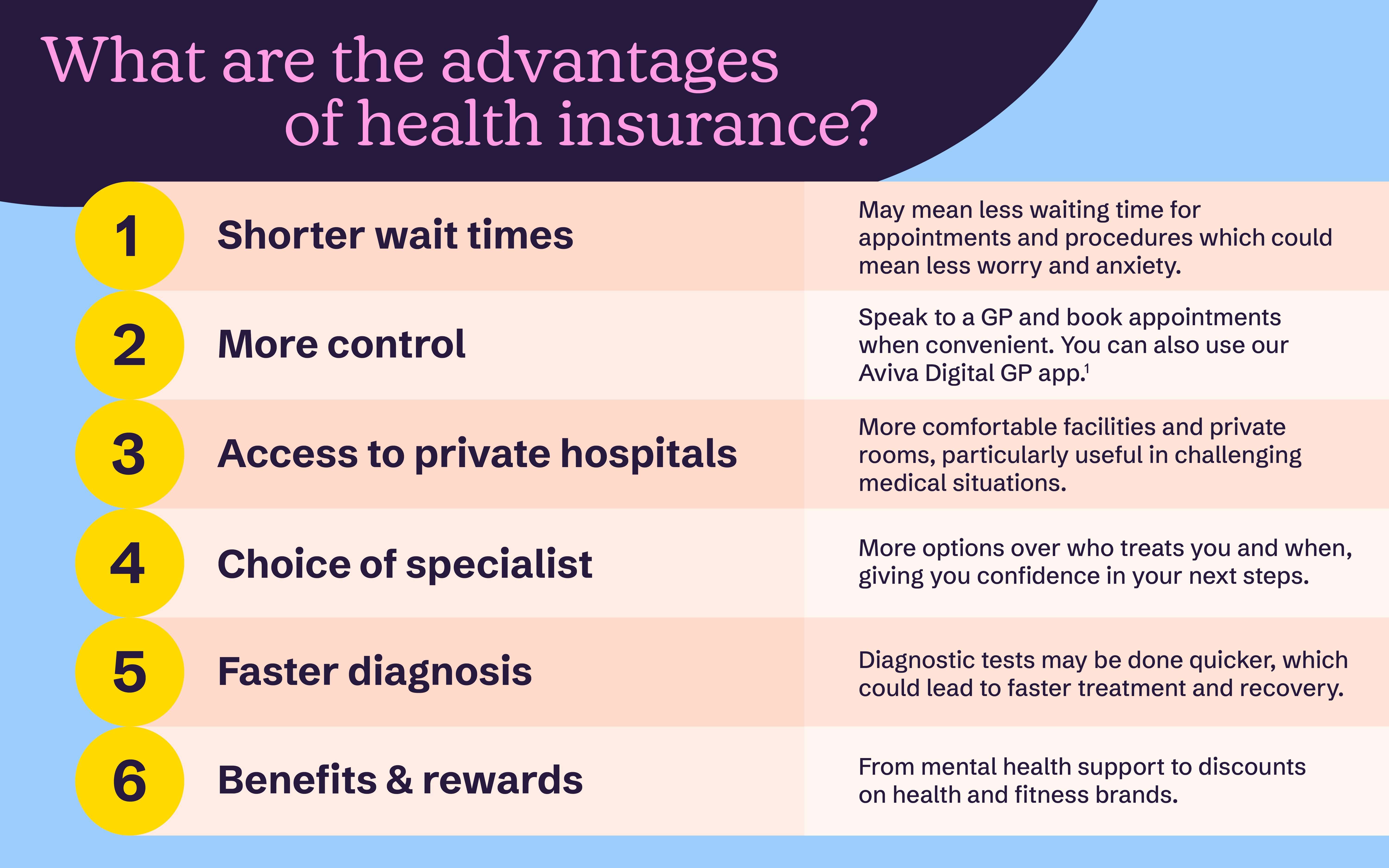

What are the advantages of private health insurance?

What are the advantages?

- Shorter wait times – you may find that there’s less waiting time for appointments and procedures, so you don’t feel as overwhelmed by worry or anxiety.

- More control – with private healthcare, you may be able to speak with a GP when it’s convenient for you and book appointments or treatment around your schedule. You could also have access to private GP video consultations through an app, like Aviva Digital GP, which means you can speak with a GP virtually and could avoid the queue at your local surgery. And with some policies, you may have access to alternative therapies that you might not have otherwise.

- Access to private hospitals – if you choose to be treated in a private hospital, you may find more comfortable facilities and private rooms. Depending on the circumstances, having a choice of hospital and more privacy could give you some measure of peace in a challenging situation.

- Choice of specialist – having more options and control over who treats you and when you’re treated may help you build confidence in your next steps.

- Faster diagnosis – you may have the option of getting diagnostic tests done quicker, which could lead to faster treatment and recovery.

- Benefits and rewards – from mental health support (more on this below) to discounts on health and fitness products and services, you can find ways to keep fit and to look after your wellbeing.

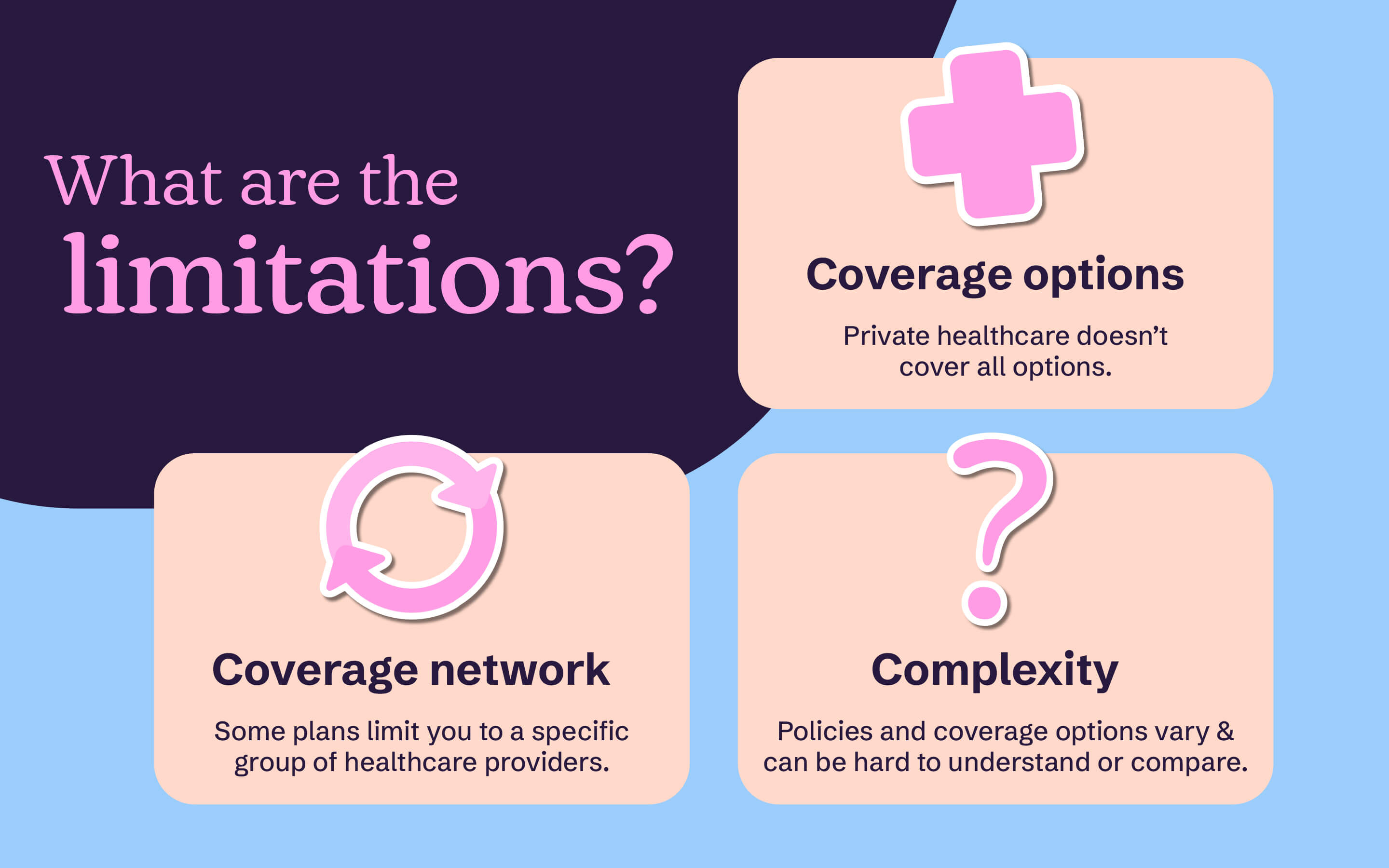

What are the limitations?

There are also limitations to private healthcare, regardless of the provider, some of which could include:

- Coverage options– private health insurance doesn’t cover all treatments and conditions. For example, many providers won’t cover emergency care, pre-existing conditions, or chronic illnesses (more on this below).

- Coverage network – some insurance plans limit you to a specific group of healthcare providers, which may be limiting when choosing doctors, specialists or hospitals.

- Complexity – it may feel overwhelming to understand and choose the right private healthcare options for you and your family. With most insurers, you’ll find different policies with varying levels of coverage, exclusions, and terms, all of which may feel like it’s clear as mud when reading through the information.

What does private health insurance cover?

This largely depends on the insurer and the type of policy, but it could include some:

- inpatient treatments – this is medical care that means you’d stay in hospital overnight or for an extended period. For major operations, you’ll likely need inpatient treatment so the doctor could monitor your recovery closely to make sure you’re doing well.

- outpatient treatments – these are minor treatments that mean you won’t stay in hospital overnight. It could also cover consultations with specialists and some tests to help diagnose medical issues.

- daypatient treatments - this is when you go to hospital for care that needs a bit of recovery time, but you don’t stay overnight. You’ll be looked after by medical staff for a few hours, then head home the same day once you're cleared by your doctor.

- physiotherapy – physical therapy to help you recover from injuries, manage pain and improve what you can do physically. It’s often used to help with conditions like arthritis, back pain, sports injuries or recovery after surgery.

Short term illness

From a minor moped mishap to a painfully inflamed appendix, you may look for private healthcare that takes care of the bumps and bruises that don’t last long (even if they feel like they do).

You might see this called ‘acute conditions’, and it means having cover for short-term illnesses or injuries that respond quickly to treatment. For many insurers, this is part of their standard cover.

Cancer care

Whether you’ve found an unexpected lump or simply checking your health against your family history, the thought of cancer may be quite distressing. From family and friends to healthcare providers, it’s important to make sure you have the support to get you through it.

Most private healthcare will cover cancer care, however, you’ll need to check carefully what this includes. This may be early risk tests, some types of screenings and certain treatments.

If you’d like an idea of what to expect from us, check out our cancer pledge.

Mental health

Caring for your emotional and mental wellbeing goes hand in hand with looking after your physical health. And most insurers recognise this, too.

With our standard health insurance, for example, you’ll get up to £2,000 of cover for outpatient mental health treatment, which includes therapy or counselling, for common conditions like anxiety, depression, eating disorders and OCD. You’ll also have access to:

- our Stress Counselling helpline with trained professionals, available 24/7.

- discounts on lifestyle products and offers at over 3,500 health and fitness clubs.

- materials on a range of topics meant to educate and support your mental health.

And you can check out more details on whether mental health care is covered by health insurance.

Hospital charges and specialist fees

This means that, depending on the insurer, they could help pay for certain costs related to your stay and treatment in a hospital. This may include:

- room and board – this means the cost of your hospital room, be that in a shared ward or a private room.

- nursing care – services given by nurses during your stay.

- medical supplies – things like bandages, syringes and other supplies related to your care.

- operating theatre fees – costs related to using the operating room for surgeries.

Specialist fees are any charges related to medical specialists for their services. This may be:

- consultations – fees for appointments to talk about and diagnose your condition.

- procedures – this means costs related to medical treatments or surgeries undertaken by the specialist.

- follow-up visits – any appointments following your first visit.

What doesn't private health insurance cover?

When exploring private healthcare in the UK, it’s important to recognise that there are some things that some insurers won’t cover.

Long term conditions

You may see this called ‘chronic conditions’ and means a long-term health issue that may not be curable, but may be managed with ongoing treatment. These types of illnesses need continuous care and monitoring. Some examples include:

- diabetes

- arthritis

- epilepsy

- asthma

It’s worth noting that cancer isn’t considered a chronic condition.

Pre-existing conditions

Most insurers won’t cover you for conditions that you have before joining them, unless their underwriters allow it, because health insurance is normally meant for new or unexpected medical conditions.

Life events

Life events like pregnancy, childbirth and menopause aren’t covered by most insurers. But some insurers may cover related conditions that could be experienced outside pregnancy and childbirth, so it’s important to check your policy details.

We also know that life can throw all sorts of changes your way, and your wellbeing needs might shift over time. That’s why we offer a range of wellbeing services that are there to support you, whether you're starting a family, going through menopause, or just navigating everyday ups and downs. It’s about having support that grows with you, whatever life brings.

Cosmetic procedures and overseas treatments

For most insurers, cosmetic procedures are seen as surgeries or treatments meant to improve how you look rather than needed for medical reasons (except following an accident or surgery for cancer). Because they are optional rather than medically necessary, most policies won’t cover them.

Who does it cover?

Insurers will give you a choice of who you want your health insurance to cover. This could mean it’s:

Individual cover

Individual cover

Just for you

Joint cover

Joint cover

For you and your partner

Family cover

Family cover

For your immediate family members

Making a health insurance claim

Coping with medical worries may be challenging enough as it is, so reducing the stress of making insurance claims by understanding the process may be a high priority.

And although the process may differ slightly from one insurer to the next, there are some parts that remain similar.

Visit your GP

Visit your GP and they’ll refer you for any further investigations or treatments you may need. You may want to tell them that you have private healthcare.

You may get an open referral, where your GP says what kind of treatment you need but doesn’t point you to any specific specialist or hospital. Or, you could get a named referral, if your GP gives the name of a specific specialist at a particular hospital. You may ask for an open referral, so you have more flexibility.

Remember to get in touch with your insurer before you have tests or treatment, so you know it’s eligible for cover. That way, you won’t have any unexpected costs.

Start your claim

Start your claim by contacting your insurer over the phone, through their website or an app, like MyAviva, which allows you to see and manage your Aviva policies in one place. You’ll likely need to describe your symptoms and have a chat about your next steps. The next steps usually include choosing a specialist at a hospital on your list and arranging an appointment.

Check back in with your insurer

After your appointment, check back in with your insurer if your specialist refers you for more treatment (that’s not yet approved).

Let your insurer settle authorised bills

Let your insurer settle authorised bills, once you’ve had the care you need, directly with your medical provider. But it’s also worth remembering that you’ll likely need to pay the excess or any treatment after a benefit limit has been reached.

Check out more details on how to make health insurance claims with us. |

How health insurance excess works

If you make a claim on your health insurance policy, an excess is the amount you agree to pay towards your treatment. This amount will have an impact on your premium and could help decide how much of a discount you get.

The excess amount will vary depending on the insurer. With our Healthier Solutions policy, for example, you can choose from £100, £200, £500, £1,000, £3,000 and £5,000.

When you first apply for cover, or when the policy is due for renewal, you can choose an excess amount that’s right for you. For example, let’s say you agree to a £500 excess and have a procedure covered by your policy that costs £2,000. It’s your first claim in the policy year, so when it comes to paying the bill, you’ll pay £500 and your insurer will pay the remaining £1,500.

And it’s worth remembering that choosing to pay a higher excess could lower the cost of your cover. As this means you'll pay more upfront if you make a claim, just make sure it's an amount you can afford if you need to claim.

Navigating the complexities of private health insurance can sometimes feel overwhelming, but understanding your options may help you to make the best choices for your health and wellbeing.