An overview of annuity rates

Annuities give you a guaranteed income for the rest of your life. But exactly how much could you get?

We reveal how your annuity rate is calculated, how much you could expect to receive every year for the rest of your life – and how you could potentially increase the amount of money you get. First up…

How big is your pension pot?

The size of your pension pot determines your annuity income more than anything else. Simply put, the more pension money you use to buy your annuity, the higher your annuity income will be.

If you want to find out how much your pension is worth, check your latest pension fund statement – it should contain your current pension fund value (although you should remember that this may change before you decide to take your benefits). If you have more than one pension, check the latest statement for each one.

Bear in mind, you can normally take out up to 25% of your pension in cash before using the rest to buy an annuity. But the more you take out, the less you can put towards your annuity – and the lower your income will be.

Your age, goals, medical conditions and more

It's not just the size of your pension that matters. Your age and health both affect how much annuity income you'll get in different ways.

For example:

- The younger you are, the less income you'll receive at the start of your annuity. But taking it sooner means you may be paid more over the long-term

- Certain medical conditions and lifestyle choices, like heavy smoking, can get you more income. But you might collect less over the long-term if you pass away due to health problems

In general, the older you are when you buy an annuity, the higher your starting rate will be. You'll usually get a higher rate if you buy an annuity when you're 70-years-old than when you're 60 for example.

Of course, you could be paid less over the long-term than if you start your annuity sooner, so its important to consider your future goals. Also, it's important to consider if you qualify for an 'enhanced' annuity rate.

How to get an enhanced annuity rate

An enhanced annuity is an industry term that essentially means "more money". But how do you get your hands on it?

It's all to do with the state of your health. For example, here's a few things that could get you an enhanced annuity:

- If you are or have been a heavy smoker

- Being overweight

- A health condition like high blood pressure or diabetes

You could also get an enhanced rate if you add a partner who has a medical condition or poor health to your annuity too. Overall, enhanced annuities can secure you up to 30% Footnote [1] more income.

As you can see, when you're shopping around for an annuity, it's worth telling the provider any medical and health conditions you and a partner may have. It could make all the difference in getting you an enhanced annuity rate. Your partner doesn't have to have a medical condition to affect your annuity rate however. Simply including a partner in your annuity can change how much income you receive each year.

25% of customers under-disclose their medical history Footnote [2]. The best way to boost your income is to provide as much information as possible about your conditions, including any medical letters or hospital reports if available. The following case studies show the benefit of providing medical letters when applying for an annuity:

Mr E had a recent history of prostate cancer, allowing us to offer him an annuity with an enhanced income. We subsequently received medical letters about Mr E’s condition that confirmed the cancer’s staging and classification – we were then able to raise his annuity income further by over 10%.

Mr H is a diabetic, and we offered him enhanced annuity rates. After receiving medical letters, we could see that Mr H has a history of high diabetic readings and reduced kidney function. Taking this information into account, we were able to increase his annuity by a further 16%.

Are you single or in a relationship?

If your annuity is just for yourself, then you'll often get a higher rate than if you share it with a healthy partner.

If you buy a 'joint annuity' on the other hand, your annuity rate will go down. This is because your provider pays some of your income to your partner for as long as they live after you die.

Regardless of whether you're single or in a relationship, there's a few other factors that impact annuity rates and the income you receive no matter what.

Government, taxes and interest rates

Just like your income from your job, the income paid by an annuity is taxed under PAYE rules. This means that it will change when those rules change, as well as for other reasons outside your annuity provider's control.

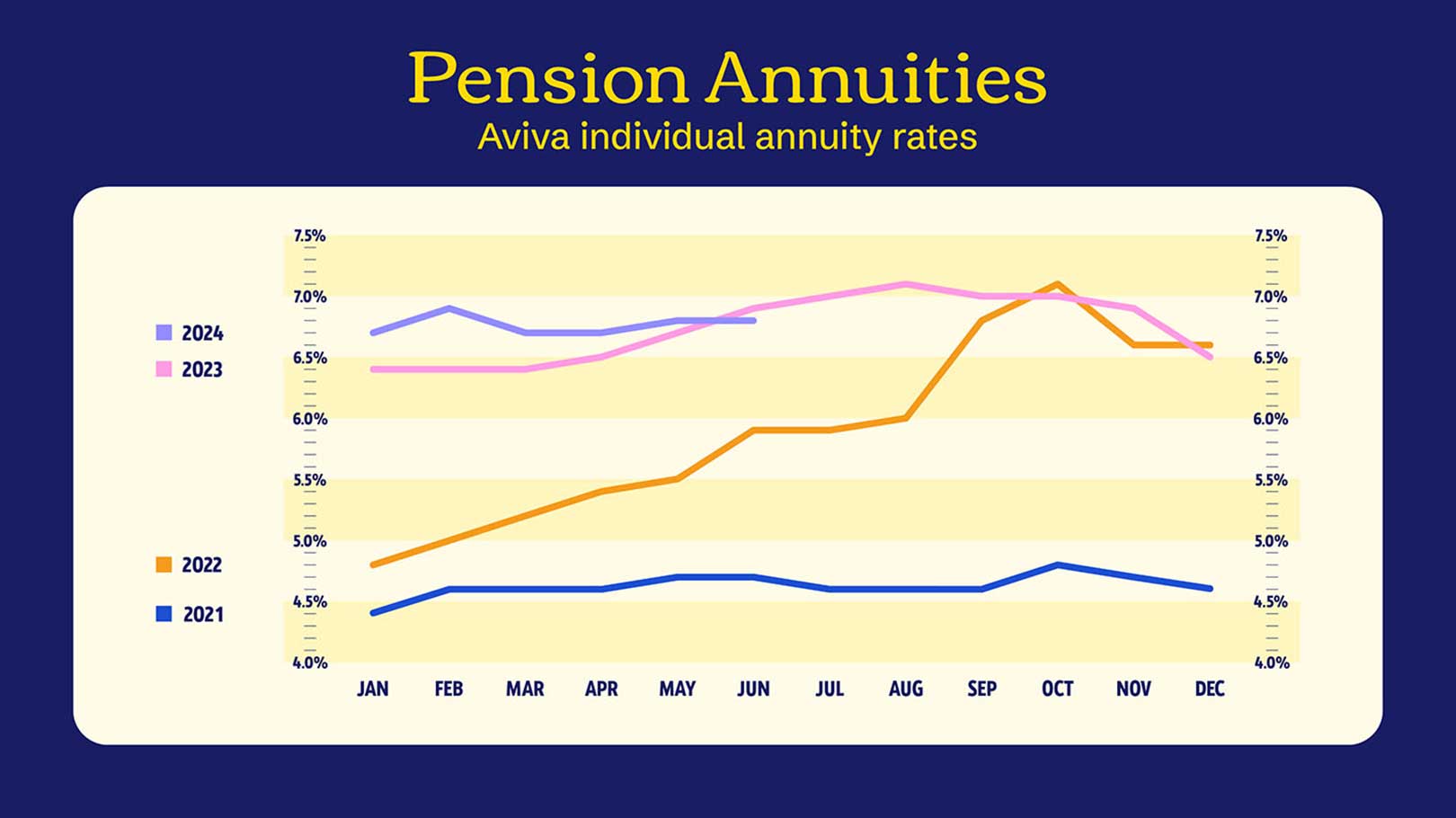

For example, when interest rates are low, so too are annuity rates. As you probably know, interest rates were low for an extended period, although they have started to increase again. Annuity rates have behaved in the same way, increasing recently for most people after a long period at historically low levels.

You're not completely at the mercy of the government and the economy however. You do have the power to influence your rate so it's more in line with your own financial goals.

How much does an annuity cost?

In short, it depends. The cost of an annuity can rely on a few things. Firstly, you and your health are taken into consideration. Then there’s the decision of retirement options that you choose. You may want to use 100% of your pension pot to buy your annuity, or you may want to take a lump sum and use the rest for an annuity. There’s no one set ‘price’ when it comes to an annuity, but to give you a rough idea the graph below shows our average annuity rates.

Table based on the average annuity rates for 65 year olds with a range of pension pot sizes. Footnote [2] The actual annuity rate we would offer is tailored to your circumstances and choices.

How inflation impacts annuity rates

Inflation is the way in which we measure the change in prices of goods and services. When inflation is high it means your money is worth less than the year before, and vice versa if inflation is low your money is worth more.

MoneyHelper the Governments free guidance portal have explained it like this –

‘We’ll look at it in terms of loaves of bread:

1970: £1 = 10 loaves of bread

1980: £1 = 3 loaves of bread

1990: £1 = 2 loaves of bread

2020: £1 = 1 loaf of bread.

So, £1 can buy you much less now than it could in 1970 and in another ten years it will buy even less. In fact, in 2024, the average price of a loaf of bread is £1.40, so that same £1 would now only buy 0.7 loaves of bread. This is due to inflation. This is known as the “purchasing power” of money.’ Footnote [3]

We offer two types of annuity at Aviva, and how inflation impacts these may affect your decision and which annuity you choose.

- Level annuity – This will pay you the same amount every month with no change. So, if inflation rises, although you're being paid the same amount, your money could be worth less.

- Escalating annuity – These annuities will increase your payouts by a fixed percentage or inline with inflation based on either the RPI or CPI.

Influence your annuity rate with these three options

When you take an annuity with a provider like Aviva, you have three options to choose from. All of these options affect your annuity rate.

With Aviva your annuity income can either:

- Stay the same for the rest of your life

- Increase at a fixed rate every year

- Increase in line with the Retail Price Index (RPI)

You'll get a higher income early on in your retirement if you choose 'stay the same' option. But your income may go up to an even higher level later on in retirement if you choose 'increase at a fixed rate every year' or 'increase in line with the Retail Price Index (RPI)'.

What you choose depends on what your goals are for retirement and your financial future. So how much money do you think you'll want in retirement?

Find out how much you could get – use our annuity calculator today

Get a quick quote with our annuity calculator for an idea of how much we could pay you for the rest of your life. Its easy-to-use and can be completed in 2 minutes or less.

Any information you enter is 100% secure and anonymous – we don't ask for your name.

You can use the calculator even if you don't have a pension with Aviva, although you do have to be a UK resident aged 55 to 74.

Remember, our annuity calculator quote isn't a guaranteed quote. This is only an estimate.

Or if you'd like more information on how Aviva's annuity works, you can find out more information here.

Pension annuity calculator

Learn more about the sort of income you might receive from an annuity with our calculator. It's free, quick and easy-to-use.