What is life insurance?

Life insurance pays out a sum of money if you die while you hold the policy. Your loved ones could use the money to help pay bills or maintain their living standards when you're no longer here.

There are different types of life insurance:

- Term life insurance – which lasts for a specific length of time

- Whole of life insurance – which lasts your entire life

How our Life Insurance Plan works

On this page, we're talking about our Life Insurance Plan, which is term insurance. It's easy to apply for it online and could give you some peace of mind that your family are protected financially.

Who can apply for our Life Insurance Plan?

To apply for cover, you must be:

- aged between 18 and 77; and

- in the UK with a legal right to live there. You must consider your main home to be in the UK (which doesn’t include the Channel Islands, the Isle of Man or Gibraltar) and have no current intention of permanently moving elsewhere.

In most cases, you won’t need a medical exam. But if we do ask you to have one, we’ll cover the costs.

What our life insurance covers

Here’s more about what’s covered, and what to bear in mind before you go ahead.

What's covered

- Lump sum payment

You can choose up to £5 million worth of cover and we’ll pay the full amount after a successful claim.

- Protection if you die

We’ll pay a lump sum if you die during the policy term – simple as that. Your policy ends when we pay out and we won't pay any further claims. - Terminal illness

You’ll get your lump sum payment early if you’re diagnosed with a terminal illness that meets our definition and you’re not expected to live longer than 12 months. Your policy ends when we pay out and we won’t pay any further claims. - A separation benefit

If you separate from your partner, we could split your joint policy into single policies. - House purchase cover

If you’re taking out cover to coincide with buying a new home, we’ll give you up to 90 days’ free life insurance. This begins when we’ve accepted your application and you’ve exchanged contracts or completed missives, as long as you’ve given us a future start date that coincides with the completion of your house purchase. Terms apply. See policy conditions for full details.

Important to know

- Length of cover

You can choose the length of cover you need – from short-term to 50 years, or until you’re 90 years old. - Not paying your premiums

If you stop paying premiums, your cover will end and you won’t get anything back.

- It has no cash value

We’ll only pay out on a successful claim. There’s no cash-in value at any time. The only exception to that is if you cancel within 30 days of the start date or when you get your policy documents, whichever is later. In that case, we'll refund any premium you've paid. - It pays out if you die or are diagnosed with a terminal illness within the policy term

You choose how long your policy lasts. Once it’s finished, your cover will stop and we won’t pay out if you die or are diagnosed with a terminal illness.

- Suicide and self-inflicted injuries in the first year

We won't pay out the lump sum if you die in the first 12 months of the policy as a result of suicide or intentional, self-inflicted injury.

Policy document

See a full list of what’s covered in our policy wording.

Life Insurance Plan policy summary (PDF 104 KB)

How much cover will I need?

It’s worth working out how much loved ones might need to pay off a mortgage or keep up repayments, settle any debts and cover general living costs. We have a tool to help do just that.

Why choose our life insurance?

Choosing your life cover

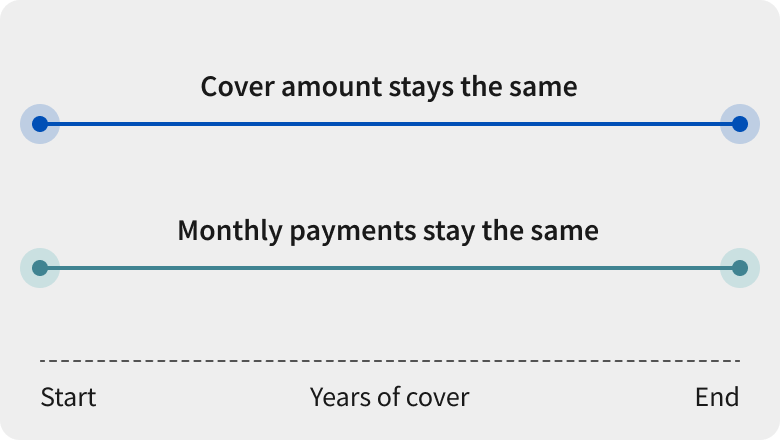

We offer two types of life insurance: level cover and decreasing cover.

Both are what we call term insurance policies – meaning they could help protect your loved ones for a fixed amount of time (otherwise known as a term).

The type of cover you want may depend on what you want to protect and how much you’d like to pay each month.

Family protection – level cover

You’ll pay the same premium for this cover each month until your policy ends, and the lump sum payout out stays the same throughout the time you hold the policy.

If you die during this time, your loved ones could use the lump sum to help them pay off debts or put it towards living costs and monthly outgoings, such as rent.

Protecting your cover from the effects of inflation

With level cover you choose a lump sum payout, but over time that could be worth less due to inflation.

You can help protect this lump sum payout against inflation by selecting increasing cover. The payout will then increase in line with inflation over time.

For example, a £100,000 lump sum would still be £100,000 in 20 years' time, but it may not buy you as much as it would now because the cost of goods and services has gone up with inflation.

With this cover, we increase the value of the lump sum payout in line with the Consumer Prices Index (CPI), calculated over 12 months. To work out the increase to your premium, we multiply what you pay by 1.5 and the percentage increase in CPI. If the CPI stays the same, neither your cover nor your premium will change over that 12-month period. The maximum yearly increase would be 15% to your premium and 10% to your cover.

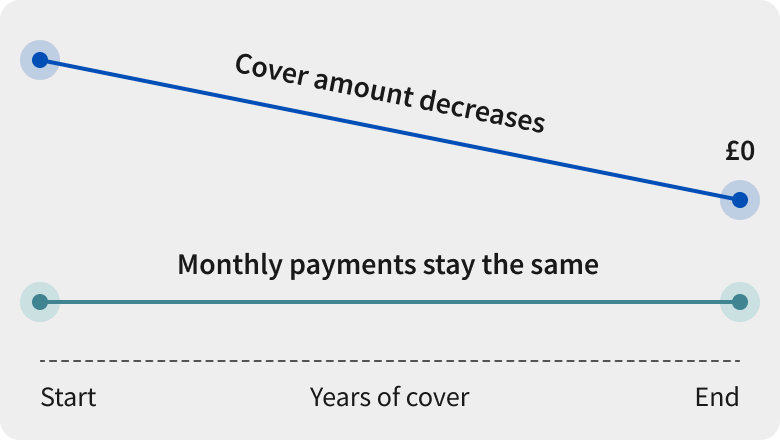

Mortgage protection – decreasing cover

You may want to choose this type of cover to help your loved ones pay off a repayment mortgage or long-term loan if you die at any time during the policy term.

The amount you have left to pay on your mortgage usually drops over time, so mortgage protection life insurance also goes down. That’s why it’s called decreasing cover and why it usually costs less than level cover.

You choose how long you want the cover to last, and your monthly premiums will remain the same throughout the term unless you make changes to your policy.

Read more about mortgage protection life insurance.

Find out more about the difference between level cover and decreasing cover.

Life insurance FAQs

Can I cancel my Life Insurance Plan at any time?

Yes, you can. When you first buy a policy, you have 30 days from either the day we tell you your policy will start or the day you get your policy documents (whichever is later) to change your mind. If you cancel during this 30-day cooling off period, we'll refund any premiums you've already paid.

You can still cancel your policy at any time after the first 30 days, but we won’t refund any premiums you’ve already paid.

Remember, your life insurance policy has no cash-in value at any time and cancelling it means you won't be able to make a claim. If you’re thinking of leaving us, we can help you consider your options.

If you decide you do want to cancel, we’ll make it as easy as possible. All you need to do is contact us.

Or you can write to Aviva Life, Norwich BCC, PO Box 520, Norwich, NR1 3WG.

Should I put life insurance in a trust?

If your life insurance policy is in a Trust, we may be able to pay the claim quicker than if your policy isn’t in a trust, provided there is at least one surviving trustee. It could also help keep the payout outside the scope of Inheritance Tax. If you're considering a trust, talk to a financial adviser. Bear in mind that tax rules may change in the future. If you don’t have a financial adviser, you can find one at unbiased.co.uk. Please be aware that you may need to pay for this advice.

What's the difference between our Life Insurance Plan and our Over 50 Life Insurance Plan?

Our Life Insurance Plan covers you for a specific amount of time, but our Over 50 Life Insurance Plan covers you for the rest of your life. The lump sum payout on an Over 50 Life Insurance Plan is usually much smaller than the payout on a Life Insurance Plan. The other difference is that you can’t take out a joint policy for our Over 50 Life Insurance Plan.

Over 50 Life Insurance Plan

You must be aged between 50 and 80 and a UK resident. You pay the same premium for life, and you won’t need a medical or health check.

The cover amount is fixed so it’s real-life value will go down over time because of inflation. You can hold a number of policies, but there’s a maximum premium limit of £100 across all policies.

You can choose either the level of cover you want or a premium you’d like to pay each month. The payout will go to your loved ones after you die, who can use it however they like.

You’ll no longer pay premiums once you’ve had your policy for 30 years or from the policy anniversary after your 90th birthday. However, your cover will continue.

For our Over 50 Life Insurance Plan, we’ll pay the full cover amount if you die after the first 12 months. We’ll also pay the full amount if you die from an accident during the first 12 months of the policy. If you die within the first 12 months of cover from anything other than an accident, we’ll pay an amount equal to the premiums paid. Depending on how long you live, you may end up paying more in premiums than the amount we pay out when you die.

Life Insurance Plan

You must be aged between 18 and 77 to apply, and your cover stops at the end of the policy term. We’ll ask you a few health and lifestyle questions when you apply. You choose a cover amount and if you want your cover to stay the same, rise in line with inflation, or go down over time in line with a repayment mortgage or loan. You can take out a single or joint life insurance policy.

There is no cash in value at any time for either product.

If you’re not sure which one might be right for you, speak to a financial adviser.

Is a life insurance payout taxable?

If you receive a life insurance payout, you won't need to pay capital gains tax, or income tax - but you might need to pay inheritance tax, unless the money is placed in a trust.

Can I have more than one Life Insurance Plan?

Yes, you can have more than one life insurance policy. If your combined cover is for a high amount, we might need to do a more in-depth financial assessment to make sure we're insuring you for the right amount.

What can I do if I am struggling to keep up with my monthly payments?

If you’re feeling any financial pressure, we're here to help you. You can explore options like reducing your monthly payments by lowering your cover amount or shortening your policy term, which could make things more manageable. We also offer a cost of living support scheme. This lets you lower your payments for now, with the freedom to increase them again in 12 and/or 24 months when you’re back on track.

Do I need a medical to get life insurance?

This depends on your age, the cover amount and the information you gave us about your health on your application. Most people who apply for our cover don’t need a medical. However, if you're applying for a large amount of cover, we might ask you to have a medical with either a nurse or a doctor. We look at everyone’s application individually. If you're asked to have a medical, it’s so we can learn more while we assess your application. It doesn’t automatically mean your application won’t be accepted.

When should I get life insurance?

You can get life insurance whenever you like, but it’s worth noting the cost tends to rise as you get older. Some life events may make you think you need life insurance, like buying a home, getting married, or having a child. You may want to make sure you’re looking after anyone who is dependent on you should anything happen to you.

What is the average cost of life insurance?

We take many factors into consideration when pricing our life insurance, but our Life Insurance Plan starts from as little as £5 a month. There is no average cost as the price you pay depends on the level of cover you choose, the duration and your personal circumstances.

How long will it take to get a payout on a claim?

It varies, but once we’ve discussed the claim, we can usually estimate timescales. Once we've agreed to pay the claim and have everything we need, we’ll aim to pay out within five working days. The process may be quicker if you place your policy in a Trust. We will pay the claim proceeds to the trustees (provided there is at least one surviving trustee), so we won’t need to wait for personal representatives to be appointed to administer your estate.

To make sure a Trust is the right option for you, it's a good idea to seek independent legal and financial advice before you start, for which there may be a charge. Visit unbiased.co.uk or lawsociety.org.uk for help finding an independent adviser.

Looking for different cover?

We have other types of protection cover to help during difficult times.

Over 50 life insurance

Guaranteed life insurance cover for the rest of your life that pays a lump sum when you die. If you die within the first 12 months of anything but an accident, we’ll pay an amount equal to the premiums you’ve paid, but not the cover amount. We won’t ask you any health questions when you apply.

Age: 50-80

Cover: £5 - £100

Payment: When you die. There’s no cash-in value at any time.

Critical illness cover

Pays a lump sum if you or your child are diagnosed with or have surgery for one or the 52 critical illnesses covered by our plan within the policy term.

Age: 18-64

Cover: Up to £1,000,000

Payment: If you become critically ill and live for 10 days after diagnosis. There’s no cash-in value at any time.

Income protection insurance

Affordable cover that pays a proportion of your lost earnings, which could help you cover your monthly outgoings if you can’t work.

Age: 18-59

Cover: Monthly benefit between £500 and £1,500

Payment: If you’re ill or injured and can’t work. There’s no cash-in value at any time.

Life insurance knowledge centre

Get insight and useful info on protecting you and your family.